irs child tax credit 2022

The advance is 50 of your child tax credit with the rest claimed on next years return. Ad The new advance Child Tax Credit is based on your previously filed tax return.

Don T Throw Away This Document Why Irs Letter 6419 Is Critical To Filing Your 2021 Taxes Usa Today In 2022 Irs Taxes Filing Taxes Irs

2022 Irs Tax Advice What You Need To Know About Child Credit And Stimulus Checks Kob 4

Child Tax Credit 2022 Qualifications What Will Be Different

Child Tax Credit 2022 When Is The Irs Releasing Refunds With Ctc Marca

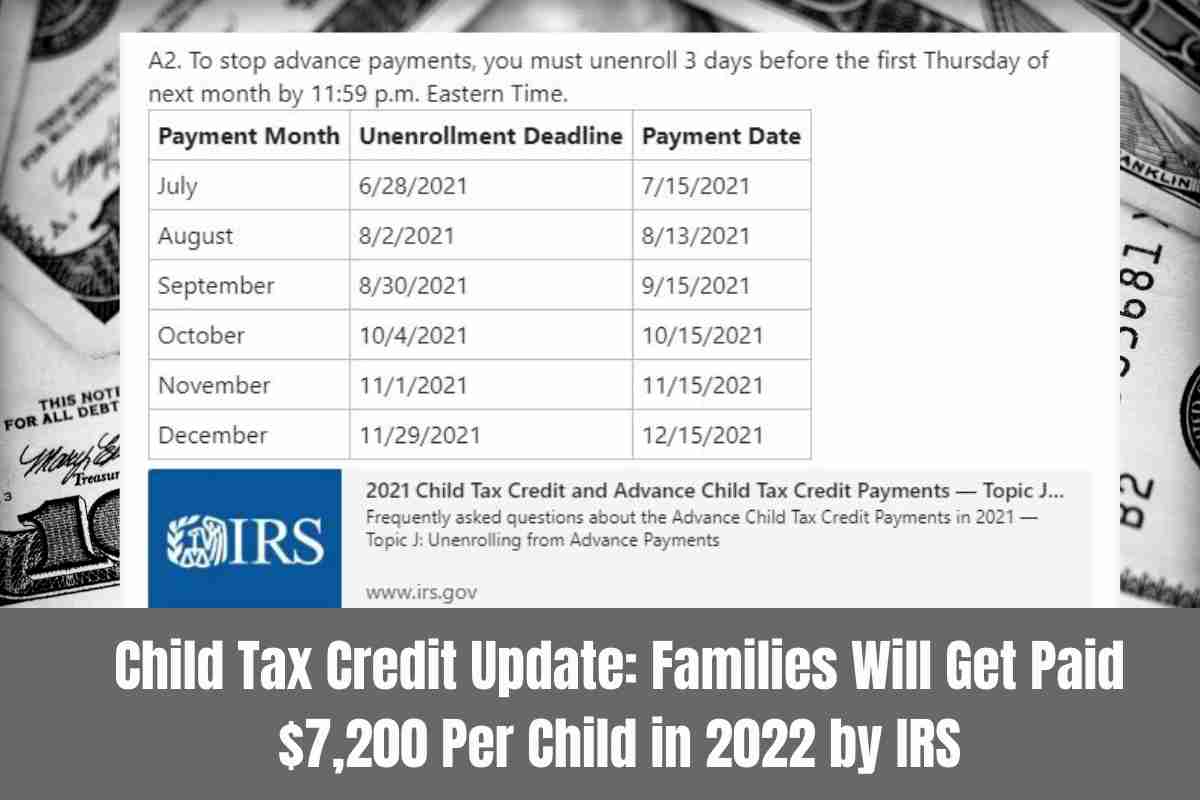

Child Tax Credit Update Families Will Get Paid 7 200 Per Child In 2022 By Irs Csu World Record Breaking News

Some Families Missing Out On Child Tax Credit

Child Tax Credit How Families Can Get The Rest Of Their Money In 2022

Child Tax Credit 2022 Irs Warns Of Errors In Letter 6419 What Should You Do As Com

Child Tax Credit Update Families Will Get Paid 7 200 Per Child In 2022 By Irs Fingerlakes1 Com